Top Tips For Getting Excellent Home Mortgages

Content written by-Connor EganBuying a new home can be fun if you do not get overly stressed during the approval process. There are many criteria you need to meet in order to finance your home and it is important to learn more about mortgages before you apply for one. You should keep reading for some useful tips on mortgages before making any important financial decisions.

When trying to figure out how much your mortgage payment will be each month, it is best that you get pre-approved for the loan. Look around so you know what your price range is. This will help you form a budget.

Watch out for banks offering a "no cost" mortgage loan. There is really no such thing as "no cost". The closing costs with "no cost" mortgages is rolled into the mortgage loan instead of being due upfront. This means that you will be paying interest on the closing costs.

Set your terms before you apply for a home mortgage, not only to prove that you have the capacity to pay your obligations, but also to set up a stable monthly budget. This includes a limit for your monthly payments based on the amount you're able to afford instead of just the type of home you desire. No matter how awesome getting a new house is, if you're not able to get it paid for you will be in trouble.

Get mortgage loan estimates from at least three different mortgage lenders and three different banks. By shopping around, you may get a lower interest rate, pay fewer points and save money on closing costs. https://njbiz.com/pic-page-march-14-2022/ 's almost always preferable to get a fixed interest rate. With variable rates, you may not know from month to month what your mortgage payment will be.

Don't forget to calculate closing costs when applying for a mortgage, particularly if this is your first time. Above and beyond the down payment, numerous charges exist simply for processing the loan, and many are caught off guard by this. You should anticipate paying up to four percent of the mortgage value in total closing costs.

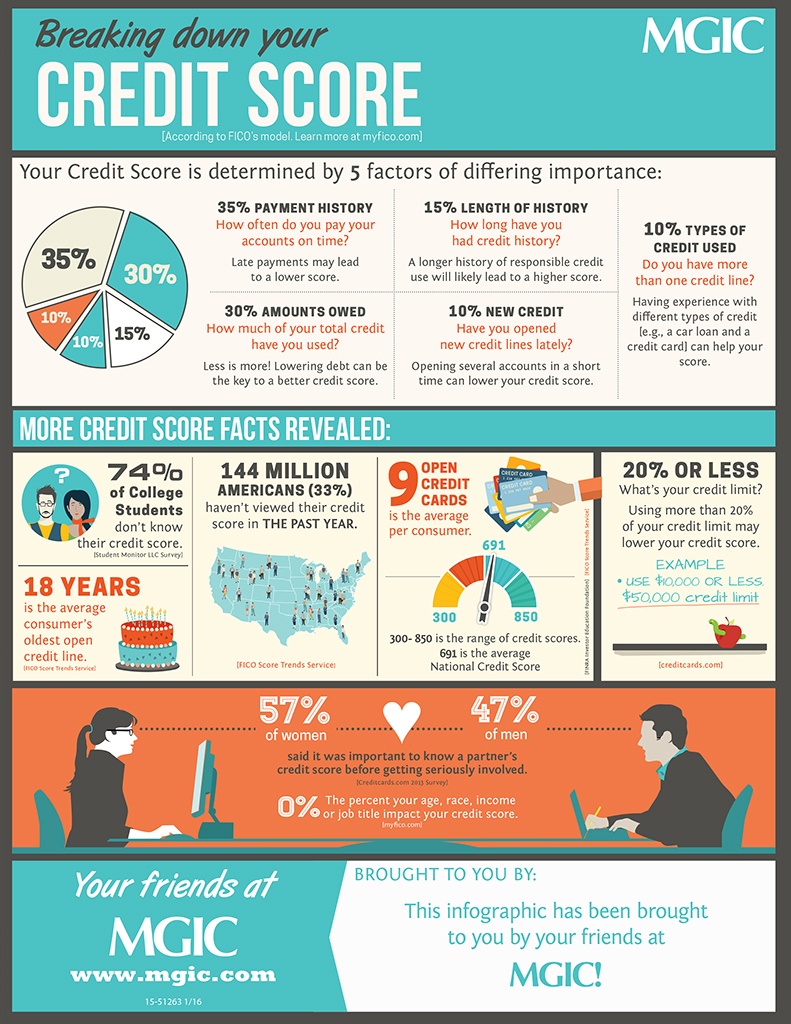

Obtain a credit report. It is important to understand your credit rating before you begin any financial undertaking. Order reports from all 3 of the major credit reporting agencies. Compare them and look for any erroneous information that may appear. Once you have a good understanding of your ratings, you will know what to expect from lenders .

Monitor interest rates before signing with a mortgage lender. If the interest rates have been dropping recently, it may be worth holding off with the mortgage loan for a few months to see if you get a better rate. Yes, it's a gamble, but it has the potential to save a lot of money over the life of the loan.

Put as much as you can toward a down payment. Twenty percent is a typical down payment, but put down more if possible. Why? The more you can pay now, the less you'll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars.

Save up for the costs of closing. Though you should already be saving for your down payment, you should also save to pay the closing costs. simply click the following post are the costs associated with the paperwork transactions, and the actual transfer of the home to you. If you do not save, you may find yourself faced with thousands of dollars due.

Before you apply for a mortgage, know what you can realistically afford in terms of monthly payments. Don't assume any future rises in income; instead focus on what you can afford now. Also factor in homeowner's insurance and any neighborhood association fees that might be applicable to your budget.

Pay off more than your minimum to your home mortgage every month. Even $20 extra each month can help you pay off your mortgage more quickly over time. Plus, it'll mean less interest costs to you over the years too. If you can afford more, then feel free to pay more.

If you wish to buy a home in the next year, try establishing a decent relationship with the financial institution. Start by taking out a loan for something small before you apply for a mortgage. This shows your lender that you can meet your obligations.

You likely know you should compare at least three lenders in shopping around. Don't hide this fact from each lender when doing your shopping around. They know you're shopping around. Be forthright in other offers to sweeten the deals any individual lenders give you. Play them against each other to see who really wants your business.

Always read the fine print. If you have a hard time understanding the information, get some help with an expert that does not work for the lending company. You want to make sure that the terms do not change after a certain amount of time. The last thing you want is surprises.

Talk to the BBB before making your final decision. Deceitful brokers may con you into paying high fees and refinancing so that they can make more money. If a broker wants you to pay excessive points or high fees, be cautious.

Get the best rate with the lender you have now by being aware of rates offered by others. There are a lot of financial institutions, both online and in the real world, that offer very good interest rates. You can use this information to motivate your financial planner to come up with more attractive offers.

There are a lot of fees associated with the process of purchasing a home and you should have them put to the side prior to applying. If a lender sees that you have enough money set aside to pay for all of your closing costs, they may be more likely to approve your loan.

Knowledge is empowering. Rather than moving forward with uncertainty, you really can proceed with solid know-how. Before entering into an agreement, carefully go over each of your options.